Crypto tax reporting guide 2024: IRS rules

Use crypto tax software to simplify reporting. Stay updated on IRS rule changes for 2024, including new reporting requirements for exchanges.

Transaction types and their tax treatment

- Buying crypto: not taxable.

- Selling crypto: subject to capital gain or loss.

- Trading crypto: subject to capital gain or loss.

- Receiving as payment: treated as regular income.

- Mining rewards: treated as regular income.

When in doubt, consult a tax professional familiar with crypto regulations.

Basics of crypto taxation

Understanding how cryptocurrencies are taxed is key for anyone using digital assets. The IRS has rules for taxing crypto, and knowing these rules helps you follow the law and avoid penalties.

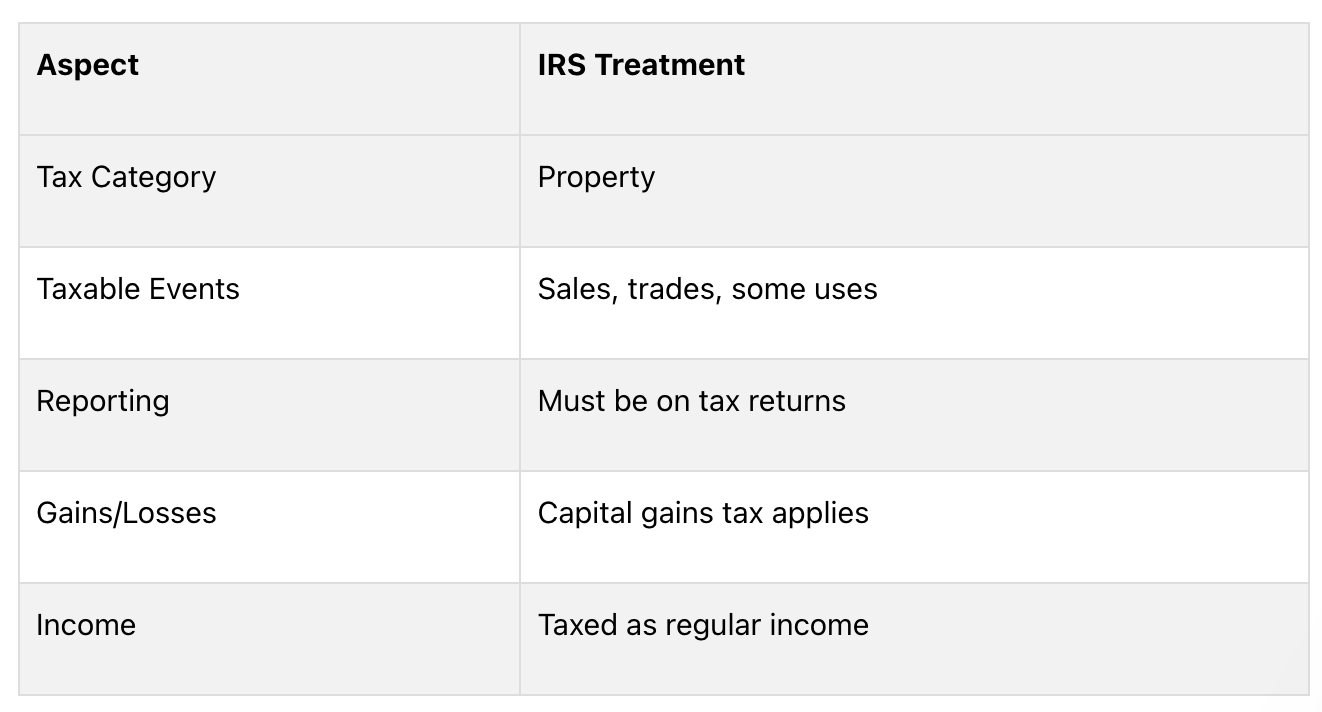

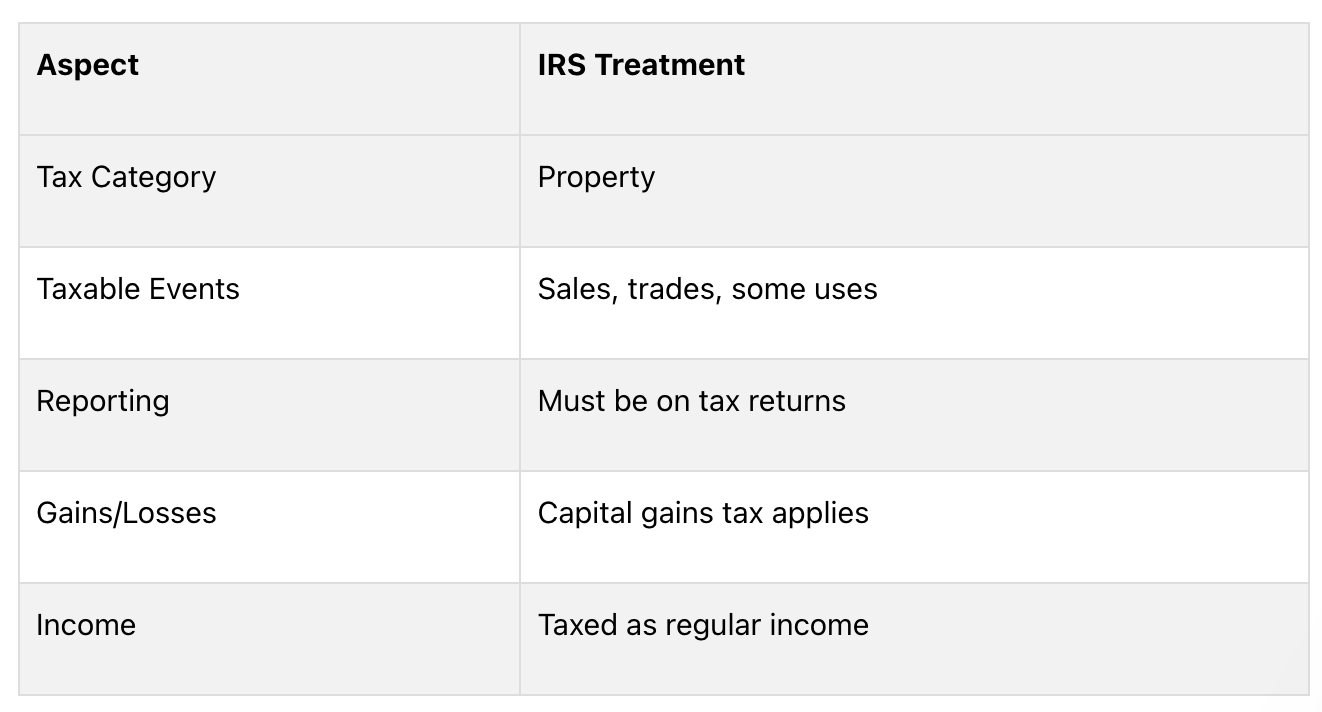

How the IRS views crypto

The IRS treats crypto as property, not money. This affects how they’re taxed:

Because tokens are property, the IRS uses the same tax rules for them as for other property. This means you need to report any gains or losses from crypto on your taxes.

Taxable vs. non-taxable events

Knowing which crypto activities are taxable is important for correct reporting. Here’s a simple breakdown:

Taxable events

- Selling crypto for regular money

- Trading one token for another

- Buying things with crypto

- Getting paid in crypto

- Mining crypto

- Receiving staking rewards

- Receiving airdrops or hard forks

Non-taxable events

- Buying crypto with regular money

- Moving tokens between your own wallets

- Donating crypto to approved charities

- Gifting crypto (note: gift tax rules may apply)

Even for non-taxable events, keep records. They might affect your taxes later.

Getting ready for tax reporting

Preparing for crypto tax reporting requires good organization. By gathering the right documents and keeping good records, you can make the process easier and follow IRS rules.

Collecting required documents

To report your crypto transactions correctly, you’ll need these documents:

Document type and descriptions

- Exchange Statements: records of all your trades.

- Form 1099-B: shows money from sales (provided by some platforms).

- Wallet Addresses: list of all wallets you used.

- Purchase Receipts: records of when you bought crypto.

- Sale Records: records of when you sold crypto.

- Fee Information: details of trading and network fees.

Get these documents well before taxes are due so you have time to report correctly.

Keeping track of transactions

Good record-keeping is key for accurate tax reporting. Here’s what to do:

1. Use a crypto transaction journal: keep a detailed log with:

- Date of each transaction

- Type of token

- Amount traded or moved

- Value in US dollars at the time

- Why you made the transaction (trade, buy, sell)

- Fees you paid

2. Use tax software: think about using special crypto tax software to help you. It can:

- Bring in transactions from different exchanges and wallets

- Figure out your gains and losses

- Make tax forms for you

3. Sort your transactions: group your transactions by how long you held the crypto:

- Short-term: Held for less than a year

- Long-term: Held for more than a year

4. Record non-taxable events: even if some crypto activities aren’t taxed, keep records of:

- Moving crypto between your own wallets

- Buying crypto with regular money

- Giving crypto as gifts (gift tax rules might apply)

How to Report Crypto on Your Taxes

Reporting crypto on your taxes can be tricky. Here’s a step-by-step guide for the 2024 tax season:

Figuring Out Gains and Losses

To report your crypto transactions correctly:

- Find the cost basis for each transaction

- Calculate how much you got from each sale or trade

- Subtract the cost basis from what you got to find your gain or loss

- Short-term: Held less than a year (taxed like regular income)

- Long-term: Held more than a year (lower tax rates apply)

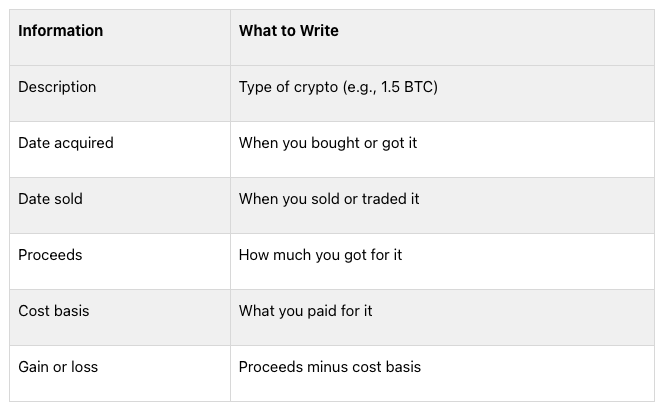

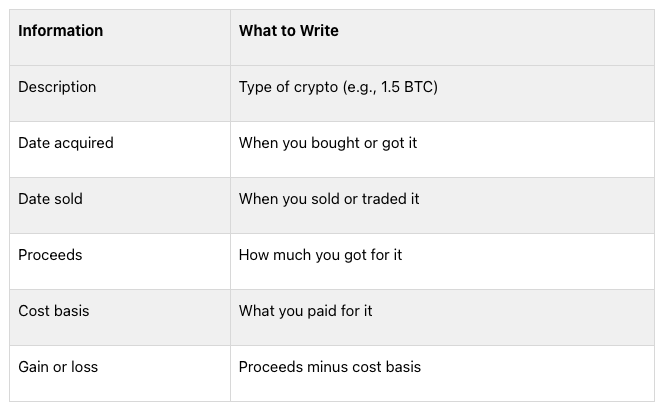

Filling Out Form 8949

Form 8949 is key for reporting crypto transactions:

- Use separate forms for short-term and long-term transactions

- Fill in the top part, checking box (c) for crypto

- For each transaction, include:

Tip: List your transactions in date order to make it easier.

Using Schedule D

After Form 8949, move the totals to Schedule D:

- Put short-term transactions in Part I

- Put long-term transactions in Part II

- Add up your total gain or loss on Line 16

If you lost money on crypto in past years, include that on Schedule D too.

Reporting Crypto Income

For crypto income not from buying and selling:

- Use Schedule 1 of Form 1040 for most crypto income (like mining or staking)

- If you work for yourself, use Schedule C

- Report the value of crypto you got as payment on the day you received it

Don’t forget to answer “Yes” to the digital asset question on Form 1040 if you did anything with crypto during the year.

Special Cases in Crypto Taxes

Crypto-to-Crypto Trades

When you swap one token for another, it’s a taxable event. Here’s what to do:

- Find the market value of the crypto you’re trading when you make the swap

- Figure out the difference between what you paid for the crypto and its current value

- Report this difference as a gain or loss on Form 8949

Note: You must report these trades even if you don’t change your crypto to regular money.

Airdrops and Hard Forks

Airdrops and hard forks can lead to unexpected taxes:

Event and Tax Treatment

- Airdrops: taxed as regular income.

- Hard forks: new tokens usually taxed as regular income.

New tokens usually taxed as regular income

For both, use the value of the tokens when you get them or can use them. Report this on Schedule 1 of Form 1040.

Lost or Stolen Crypto

Dealing with lost or stolen crypto is tricky for taxes:

Situation and Tax Treatment

- Lost crypto: usually can’t be deducted.

- Stolen crypto: not tax-deductible for individuals in 2024.

However, you might have some options:

1. Abandonment Loss:

- Might be the best choice for taxpayers

- You need proof that you meant to abandon the crypto and took action to do so

2. Exchange Shutdowns or Scams:

- Reporting losses on Form 8949 is risky

- Talk to a CPA before you decide what to do

3. Bankruptcy Cases:

- You might get a tax deduction once you know how much you’ll get back

- The deduction is what you paid minus what you get back

- It’s usually treated as a regular loss, not a capital loss

Common Mistakes and How to Avoid Them

When dealing with crypto taxes, many people make mistakes. Here are some common errors and ways to avoid them:

Not Reporting All Transactions

Some crypto owners think they only need to report big transactions. This is wrong. The IRS wants you to report all crypto transactions, no matter how small. Not doing this can cause problems:

Problem and How to Avoid It

- IRS audits: keep records of all transactions.

- Fines: use software to track all crypto activities.

- Extra charges: report even small transactions under $600.

- Possible legal issues: know the latest IRS rules.

The IRS has ways to find unreported crypto transactions. It’s important to report all your crypto activities correctly to stay out of trouble.

Wrong Cost Basis Calculations

Getting the cost basis wrong can change how much tax you owe. Common mistakes include: